This is a sponsored post.

I’ve been a bit quiet lately on my blog as I’m in the trenches of working on the business side of building my fine jewelry business. In doing so, I’ve come back to my roots in finance and accounting as I put on my business hat to look at things like cash flow, gross profit, financial projections and business plans.

Getting off brand for a moment

I have been getting out once in a while for networking events for my business, and after attending the Capital Group’s panel at the BlogHer Business conference in Los Angeles in November, I’m ready to talk about money. I realized that throughout the three years sharing inspirational topics to “Flavor Your Life,” I never really spoke about financial stuff.

But why not?

I have an undergraduate degree in Business Management with a focus in Accounting, I went to a top 5 business school for my MBA (I did drop out to run off with my then boyfriend now husband, but that’s a detail), I was a Certified Public Accountant, Finance Series 7 and 63 certified, worked in public accounting to audit huge companies, was a VP in corporate finance restructuring during the telecom bust, then built my husband’s private surgery practice for over 10 years from the ground up. Throughout it all, the key skill-set I practiced was knowing how money works.

Let’s Talk About Money

So, this post is dedicated to talking about the topic so many Americans are uncomfortable discussing.

From left to right, Justin Goodman (Editor in Chief, She Knows Media), Nicole Lapin (TV personality and author), Sherita Rankins (creator, Busywife, Busylife), Dee Mclaughlin, (Senior VP, Global Brand & Creative Capital Group)

I was initially surprised to learn that Capital Group’s Wisdom of Experience Survey showed Americans would rather talk about almost anything besides money. But then I realized I wasn’t talking about it with you, either!

I want to tell you something: There are few things in life more important to learn than understanding how the financials of your life work. And I’ve noticed my age group is having significant money shifts, whether it be divorce, health concern with themselves or a parent, sending a child to college or starting their own business.

We need to be equipped to handle and discuss our finances with our partners in our personal lives and in our businesses. And our children should learn about money at home, in addition to school.

Who handles your finances? Do you have money saved? What is your net worth? You should at the very least, know what’s going on with your assets, debt and cash flow. Ideally, you have a plan to save and invest as well. And you know how it all works.

About Capital Group

I was so excited to listen to Capital Group’s panel, headed by Dee McLaughlin (Senior VP of Global Brand & Creative), and her discussion about the importance of taking control of our financial future.

Dee Mclaughlin, (Senior VP, Global Brand & Creative Capital Group) discusses how we need to take control of our money.

Audience of 250 influencers and business women.

Do you know this company? They are legit impressive and one of the most respected investment firms in their industry.

One of their missions is to empower women at all stages of life to take control of their financial future.

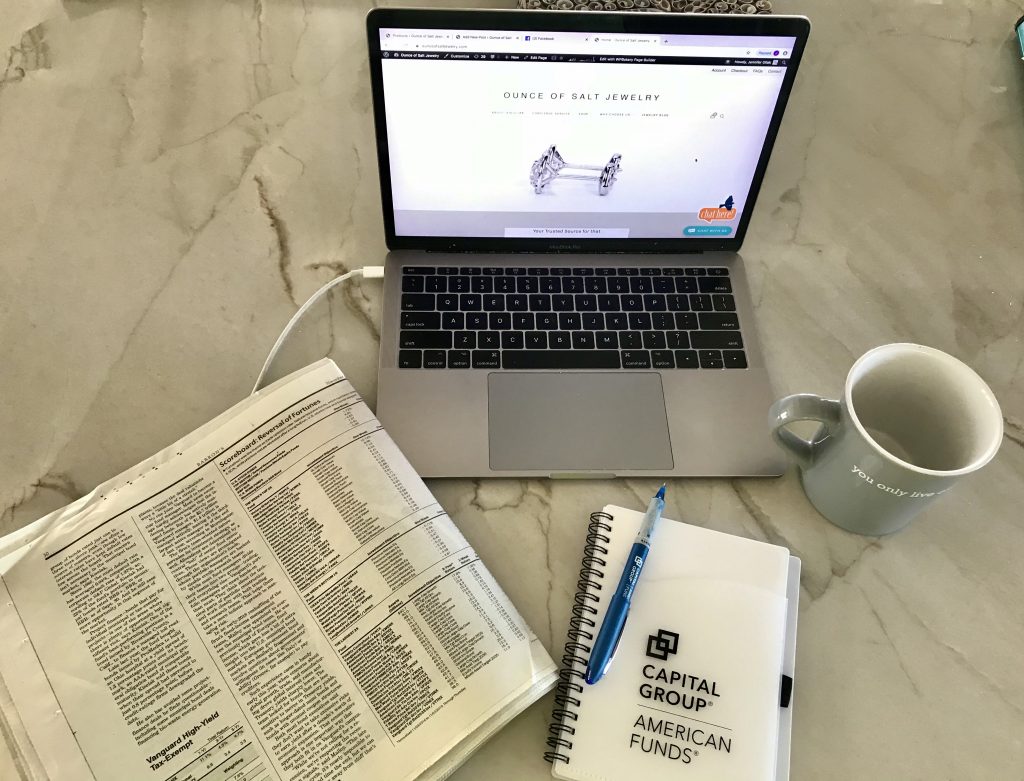

Barron’s magazine November 11 issue shows Capital Group’s American Funds at the top of their game.

For more than 87 years, Capital Group, home of American Funds, has focused on improving people’s lives through successful investing. They have 7 out of the largest 10 mutual funds in the US that vary from equity to fixed income. They also have target date funds and 529 college savings funds.

If you know me like I think you do – you know that I like to be efficient and I demand high quality. Capital Group is recognized in the industry for its low fees and superior results for long-term investors. But performance is their top priority. Net of fees, most of their Funds have beaten their benchmarks by an annual average of 1.5 percent over 3, 5, 10, and 20-year periods! That’s amazing.

Back in the day, people could only get into their funds by working through an advisor. But in recent years, they’ve made their funds available to individual investors like you and me.

It’s essential to save and invest wisely for the long term. I’m pleased to see that Capital Group has taken the initiative to work with women like me for the long haul, and through the different seasons of our lives. Having the capacity to achieve great things is inside all of us, but sometimes we need to be empowered to unlock it.

To learn more about Capital Group and its mutual funds, visit www.capitalgroup.com. When you visit, you’ll see what I mean.

Top: Nordstrom, Pants: Hark and Hammer, Shoes: Manolo Blahnik, Jewelry: Ounce of Salt Jewelry

PS. This is what I wore to the event!

Now, go learn about your personal finances if you haven’t already. I promise it isn’t that hard. You NEED to know these details. And you should also have a hand in the decision making for your money!